how to calculate nh property tax

Multiply the rate by 1000 and you get the property tax rate per 1000 of property value which is how the rate is usually stated. Then they calculate the tax rates required to equal those budgeted expenditures.

2021 Tax Rate Set Hopkinton Nh

This means the buyer will need to reimburse the seller for.

. In Claremont for example the property tax rate is 41 per 1000 of assessed. New Hampshire income tax rate. Property tax rates vary widely across New Hampshire which can be confusing to house hunters.

So if your rate is 5 then the monthly rate will look like this. The assessed value of the property. State Education Property Tax Warrant.

0 5 tax on interest and dividends Median household income. Counties in New Hampshire collect an. How to Calculate Your NH Property Tax Bill.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The result is the tax bill for the year. How to calculate property taxes.

If you take out a 30-year fixed rate mortgage this. Census Bureau Number of cities that have local income taxes. In theory at least total proceeds will equal the fund required for all previewed undertakings that year.

NH property tax rates are set in the Fall and are retroactive to April 1st of that same year. The formula to calculate New Hampshire Property Taxes is Assessed Value x Property Tax Rate1000 New Hampshire Property Tax. To calculate them you multiply the assessed value of the.

The local tax rate. This manual was the result of a collaboration of dedicated professionals who volunteered their. The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price.

New Hampshires real estate transfer tax is very straightforward. Property tax bills in New Hampshire are determined using factors. N the number of payments over the life of the loan.

For comparison the median home value in New. New Hampshire Real Estate Transfer Tax Calculator. Take the Assessed Value of the property then.

The real estate transfer tax is also commonly referred to as stamp tax mortgage registry tax and deed tax. New Hampshires tax year runs from April 1 through March 31. Are all made available to enhance your understanding of New Hampshires property tax system.

The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000. To calculate the annual tax bill on real estate when the property owner isnt eligible for any exemptions. Tax amount varies by county.

The bills due prior to the December Bill are estimated tax amounts based upon the prior years tax. It may seem complicated but it is actually simple to calculate property taxes. By law the property tax bill must show the assessed.

If a closing takes place on January 31st the seller would have already paid the December bill which covers through March 31st. The formula to calculate New Hampshire Property Taxes is Assessed Value x Property Tax Rate1000 New Hampshire Property Tax. Data and information contained within spreadsheets posted to the internet by the Department of Revenue Administration.

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

Real Estate Taxes Vs Property Taxes H R Block

Valentine S Day Math Exponential Equations

State Education Property Tax Locally Raised Locally Kept

Kentucky Usda Mortgage Upfront Guarantee Fee And The Monthly Mortgage Insurance Annual Fee

Donor Towns Tax Cuts And The Elusive Education Funding Solution New Hampshire Bulletin

Mississippi Property Tax H R Block

Things That Make Your Property Taxes Go Up

45 Walker Hill Road Ossipee Nh Real Estate Mls 4898019 Adam Dow In 2022 Ossipee Road Country Roads

State Education Property Tax Locally Raised Locally Kept

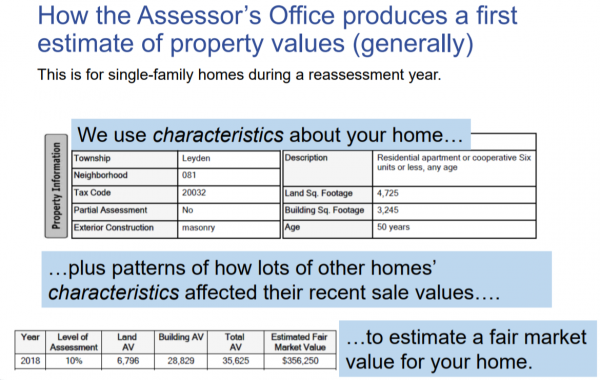

How Residential Property Is Valued Cook County Assessor S Office

About Property Tax Rates In Nh Vt Housing Solutions Real Estate

Va Lending And Property Tax Exemptions For Veterans Homeowners

States With The Lowest Property Taxes 2022 Bungalow

State Education Property Tax Locally Raised Locally Kept

States With The Lowest Property Taxes 2022 Bungalow

About Property Tax Rates In Nh Vt Housing Solutions Real Estate